By Scott Gaertner, Associate Broker

Feeling the pinch from rising home insurance premiums? You’re not alone. Across the U.S., homeowners are seeing their insurance costs jump faster than a haboob in July. But don’t worry, we’ve got some tips to help you save hundreds, if not thousands, on your insurance.

What’s Behind the Skyrocketing Costs?

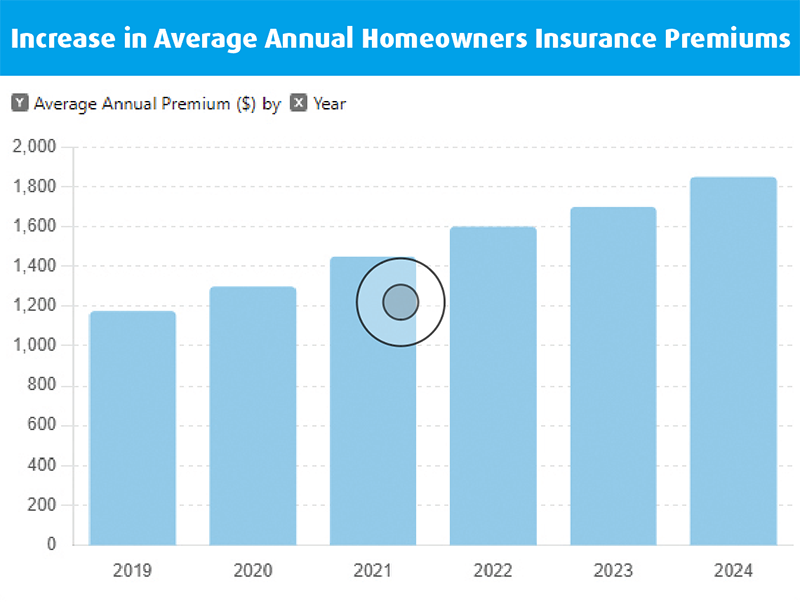

Insurance premiums are on the rise, and it doesn’t look like they’ll be coming down anytime soon. The national average annual premium went up to about $1,700 in 2023 from $1,175 in 2019. And guess what? They’re expected to go up another 10% to 15% in 2024. Some states are even worse off because they’re more prone to natural disasters.

Take Louisiana, for example. Their premiums are set to jump by 23% this year because of all the hurricanes and flooding. Florida’s homeowners are also paying through the nose thanks to the frequent hurricanes and flood damage. Even here in Scottsdale North, where we don’t have hurricanes, wildfires, or floods, we’re still seeing price hikes. Go figure!

Why Are Costs Going Up?

Here are a few reasons:

• Natural Disasters: Hurricanes, wildfires, floods—you name it, they’re happening more often and causing more damage. In 2023 alone, there were 28 weather events that each caused over $1 billion in damages.

• Inflation: The cost of building materials and labor has shot up because of inflation, making home repairs more expensive. Naturally, insurance companies pass those costs onto us.

• More Claims: Homeowners are filing more claims than expected, so insurance companies are hiking up their rates to cover future losses.

The Importance of Shopping Around

Despite the rising costs, a lot of people don’t bother to shop around for better rates. Big mistake! One of our clients had been with USAA for years, thinking loyalty would get him the best deal. Wrong! He shopped around and found out he was overpaying by a lot. Remember, sticking with one insurer doesn’t always get you the best deal.

How to Beat the Rising Costs

Fortunately, there are ways to handle these rising costs, and the best one is to shop around. We help our clients by finding the best providers and vendors. We’ve teamed up with a fantastic company that checks insurance rates from multiple companies for you. They’ll find the cheapest provider initially and keep an eye on your policy to notify you if a cheaper option becomes available later. It’s like having your own personal insurance shopper!

Contact Us for Help

If you’re worried about rising insurance costs or need any real estate advice, give us a call at 480-634-5000 or email [email protected]. Protecting your biggest asset doesn’t have to break the bank. We’re here to help you through these challenging times.

While I have you… See the back page of this paper.

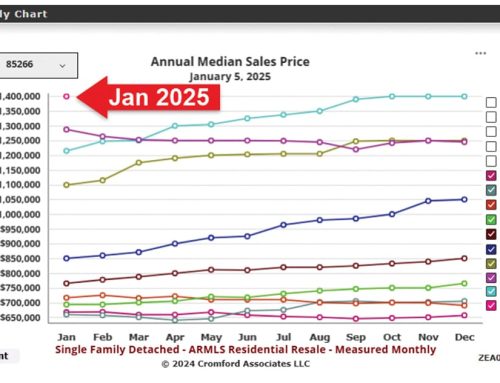

Want An Instant Home Value? Check out Homebot, the best home valuation tool I’ve found. It provides monthly valuations with trendlines and detailed information, all without being intrusive. Homebot is surprisingly accurate, helping you stay on top of market trends and make informed decisions. Subscribe today to get your personalized home valuation updates!