A local company helps you build better credit for a better future

An Experian study indicates that as many as thirty percent, or more, of Americans have bad or poor credit. In addition to that startling figure, 39 percent of Americans don’t have enough money on hand to cover a $400 emergency expense, according to the Federal Reserve.

A poor credit score—which is often the result of a few mistakes or life circumstances that may be out of your control—can impact many facets of your life. From qualifying for a place to live, to a vehicle to drive, or rates on educational loans for ourselves or our children, most of our major purchases are impacted by our credit scores. Luckily, local company Credit All Better specializes in helping Valley residents to improve their credit scores and their futures.

“We [Credit All Better staff members] have many years of experience in evaluating credit and guiding consumers to assert their legal rights,” explains John Thomas, the company’s owner. “We do it every day! We guarantee honesty and dependability; virtues which most people seem to have forgotten. Credit repair firms cannot do anything that you couldn’t do yourself, but we can help you to achieve results in a fraction of the time without making costly errors.”

How to Get Started

It all begins with a free consultation and credit analysis, Thomas says. During this consultation, Credit All Better helps the client to pull all three credit scores and reviews them in detail.

What makes Credit All Better stand out from the rest of the credit repair agencies? Thomas shares his thoughts: “We are locally owned and operated, which I think makes a difference when selecting a credit repair company to help you improve your credit score. In addition, we will tell you the truth: for example, it’s not always the best policy to dispute everything on your credit score. And not everyone is a good fit for our services—we are always honest if a potential client isn’t a candidate for our company. Honesty first is the best policy.”

How Do They Help Fix Credit?

Thomas says that Credit All Better helps its clients to improve their credit scores through a multifaceted approach:

• Their team of experts will dispute any issues or inaccuracies negatively impacting a client’s credit.

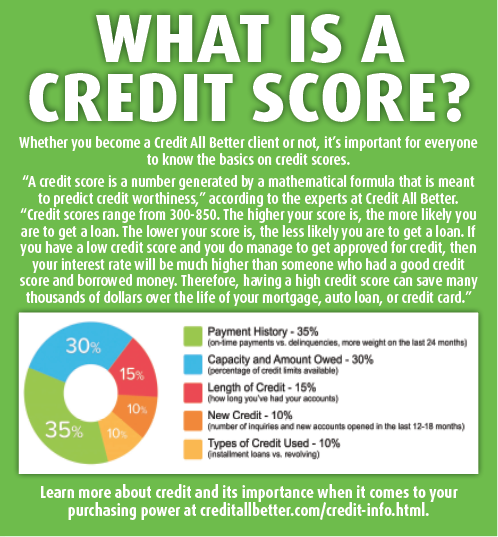

• They provide credit counseling to help clients gain a better understanding of how credit works.

• And they help clients to learn better habits so past mistakes aren’t repeated once the credit is improved.

“I made a lot of mistakes when I was young,” says one Credit All Better client. “Helping me to fix those mistakes has saved me hundreds of dollars each month.”

“Our experts will work with the credit bureaus and your creditors to challenge the negative report items that affect your credit score,” Thomas explains about the process. “Clients also have easy access to their account 24/7 for live status updates on improvements on your credit reports and scores. And, we’ll maximize your score so you can achieve your goals and learn how to maintain your awesome credit long after our work is done.”

The Credit All Better Difference

Thomas shares that there are many perks that clients can expect when working with Credit All Better:

• They offer a 100% money back guarantee.

• Their team is highly experienced in consumer, business, and mortgage credit.

• They will be intimately involved with your credit repair experience.

“Credit education and correction is legal, and the law is on your side,” he says. “We help and guide you from start to finish and we prepare all of the documentation for the various credit agencies.”

Another thing that makes Credit All Better different from its competition is its easy-to-understand low fees. “Our fees are reasonable and there are no long binding contracts,” Thomas says. “We help you to work with your files until it is done.”

Thomas shares more about their fee structure:

• Fees are as low as $59 a month.

• There is no hourly fee.

• They charge less than you would pay for a few hours with an attorney.

• They do not stick you with hidden fees.

• The initial consultation is free.

“Our service is no money down, no money for the first 30 days, then as low as $59 a month,” Thomas says. “Clients can cancel at any time! And, if they cancel, it means we did our job and helped them to fix their credit and build better habits, so they no longer need our services.”

“If you have a better credit score you could potentially have a better interest rate,” Thomas explains. “Just an increase of 20 point in your credit score can mean a difference of tens of thousands of dollars in interest saved on an average priced home and hundreds of dollars of interest saved on car payments and credit cards. We have a proven track record of helping clients to raise credit scores quickly and effectively to give them better purchasing power.”

To learn more about Credit All Better, visit creditallbetter.com where you can fill out a form requesting a free consultation.