By Frank May, Realtor

An important factor in today’s market is the number of homes for sale. While inventory levels continue to sit near historic lows, there are indications we may have hit the lowest point we’ll see. Odeta Kushi, Deputy Chief Economist at First American, recently said of our supply challenges: “It looks like inventory may have hit a bottom (we’ve seen this in the higher frequency data as well). Unsold inventory in May was at 2.5 months supply, up from 2.4.”

Although Odeta Kushi is working off national numbers, I can confirm this is happening in the local area. Our local MLS hit the low in inventory in March of this year when we were at 3,900 homes for sale. Since March, we have slowly been increasing our active inventory, and as of today, we are at 6,700 active homes. While inventory is still meager, it represents an increase of 71%. Is that a huge percentage increase? Yes. Does it mean the Arizona real estate market is crashing? No.

To put it in a bit of perspective, we had about 11,000 active homes on the market right before COVID-19 hit in March 2020. At that level of inventory, we saw multiple offers on homes listed because 11,000 is a low number of homes for sale in our market. We also have something called an Absorption Rate that I watch, which means how long it would take for us to sell all of the homes currently on the market if no more homes were listed. That rate is now at less than .7 months (less than one month to sell everything), which is extremely low.

When we dig deeper, we see that the Upper Westside had a more significant increase of inventory at 138% from March 2021 to today. I am keeping my eye on the shift as I also see the average days on market going up.

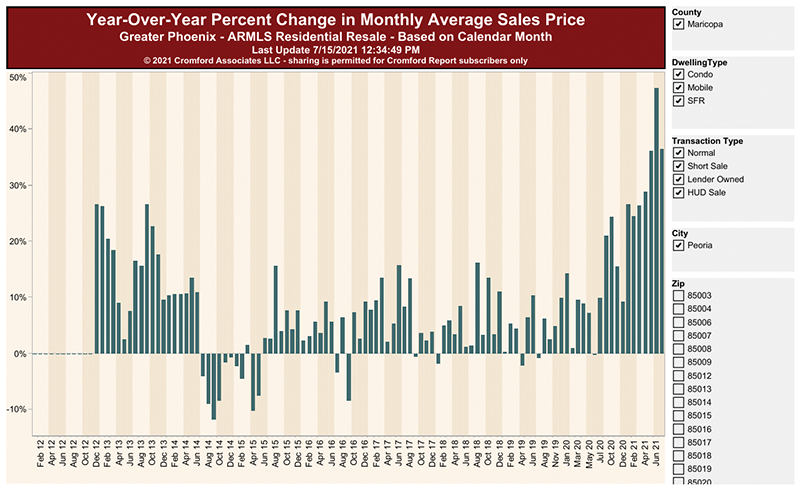

The great news in 85383 is our average sales price went up from $430,809 in June 2020 to $634,636! It was a great year to own a home in 85383!

I continue to get calls weekly from people asking if they should sell and rent for the next year because they think the market is getting ready to crash, and they don’t want to be in the same situation as they were in 2008. Since then, the lending guidelines have changed, so you could only buy a home if you could afford it. It puts us in such a better place than we were in 2007-2010. We don’t have tens of thousands of homes that are upside down. We have homes where the buyer has put money down, prices have been increasing, and they haven’t taken that equity out to finance a second or third home.

When they call asking what the future holds, I tell them that I don’t have a crystal ball, but let’s look at the numbers. We look at the rent they would be paying, and it isn’t unreasonable to pay $2,500 a month for a rental right now. They would spend $30,000 renting for the next year! You will lose whatever equity you gain while prices are going up, the equity by making your monthly mortgage payment, and that $30,000 for rent. It adds up.

If the only reason you want to sell is to avoid a crash, I would advise you not to. I can add you to my list of people who want to be notified if things change in the real estate market. Give me a call at 623-203-1800, I am always happy to help.

Frank May grew up in the Valley, graduating from Northwest Christian School and NAU. He is a real estate agent with Keller Williams Realty and has been helping both buyers and sellers for 18 years. Frank May is also a Dave Ramsey Endorsed Local Provider.