By Scott Gaertner, Associate Broker

Housing prices are rising at what feels like an irrationally fast rate, so it’s very easy to see how it feels like another bubble is on the horizon. It’s at this point you start to look for statistics that confirm your belief, confirmation bias sets in, and some objectivity is lost.

Predictable Economics And Demographics

The pandemic has made this all the more confusing, but this strong market was completely predictable. It is actually a formula that goes something like this: Economic Productivity + Favorable Demographics = Housing Boom.

The years just before the pandemic were some of the largest cycles of economic productivity in history. There has also been talk for many years previous about the coming Millennial housing boom that had to eventually happen. (Even though the Millennials are slower to blossom than past groups, there are so many of them, it had to occur sooner or later.) When you add those two conditions to the lowest interest rates ever, doesn’t a housing boom make sense?

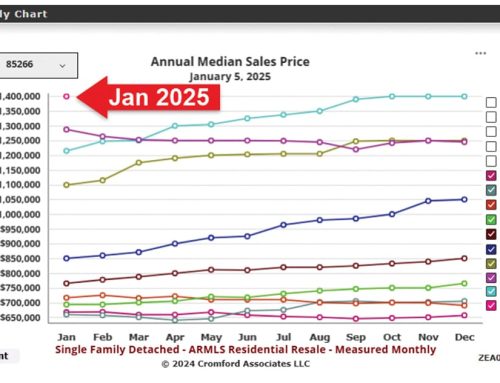

The pandemic changed the way, or possibly the where, of how the boom happened. And Scottsdale North is one of the benefactors of that shift. Working remotely is a norm and it is not going away for many. People really can live where they want to now. Reducing taxes and cost of living, finding better weather, perceived safety and less congestion, or even different politics, are all options if you don’t have to be at an office all the time.

The United States housing bubble that peaked in 2006 was largely due to ridiculous sub prime financing vehicles. It’s very different now. There’s no speculative frenzy and there aren’t any over-easy credit opportunities occurring like last time; and speculation really is one of the requirements and main ingredients for a bubble. Today’s buyers are not underqualified.

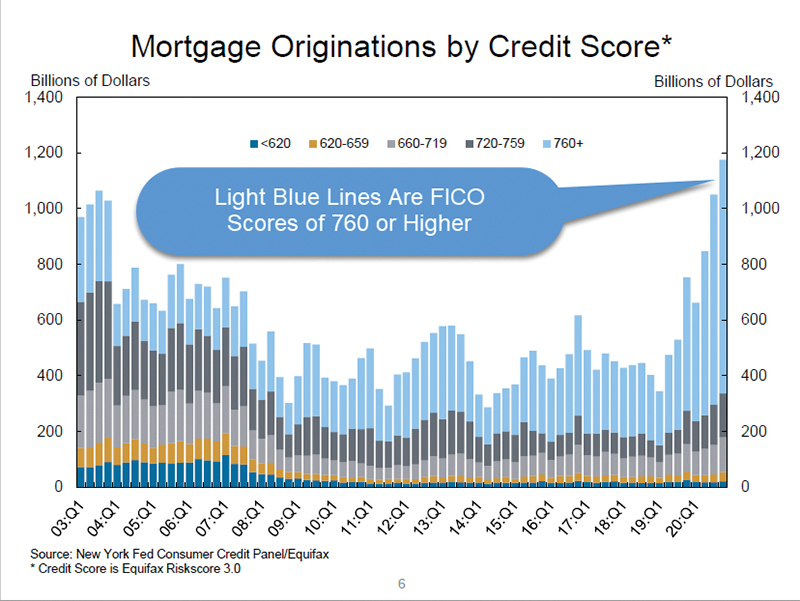

Above is the data from the New York Fed in February 2021 showing new mortgage originations have incredibly high credit scores. In fact, the Fed says that the median score for a new mortgage approaches 800. Generally, people with 800 credit scores are those that make good financial decisions.

In 2008, refinances were 90% of borrowers pulling cash out of their homes. Today only about 33% of refinances are taking money out. So the vast majority of refinances are people just reducing their payment, which will make it much less likely that they will lose their home in the future.

In order for home values to drop as they did when the bubble popped, there has to be an overabundance of homes on the market. With the unprecedentedly low inventory of homes on the market right now, the supply would have to increase significantly, just to reach what used to be the record lowest amount of homes on the market.

Distressed sales are not a problem either. Speaking of the current state of foreclosure or short sale listings, Micheal Orr of the Cromford Report says, “Among the currently pending listings we have 99.4% normal, 0.3% in REOs and 0.3% in short sales and pre-foreclosures. These are the lowest levels of distress that we have ever recorded.”

There Is No Bubble.

We have the lowest numbers ever of people losing their homes through distressed sales. The people buying homes now have put money in the house to buy it, and they are the least likely to lose their home due to extremely high credit ratings. People who have a home are now leaving their equity in their homes, and they are reducing their monthly cost by refinancing to today’s record low-interest rates. And we have a huge buffer where inventory can literally triple and we still would be less than half of what is commonly considered to be a balanced real estate market.

Nothing is certain but things are looking great for sellers and tough for buyers for the foreseeable future. But it really isn’t easy for sellers to make sure they get top dollar with the least risk and hassle, or for buyers to even get their offers accepted. No one has helped more Scottsdale North buyers or sellers be successful in this last crazy year than the Scott Gaertner Group. If you’re buying or selling give us a call at 480-634-5000. I promise you will be glad you did.

Scott Gaertner is an Associate Broker with Keller Williams Northeast, who for the past 25+ years has helped more people to find their lifestyle niche in the Scottsdale North area than anyone else. He also contributes his thoughts on lifestyle interests in the area.