By Realtor Brian Doherty, JD, LLM, ABR, PPS

Thinking of Investing in Real Estate?

Here are some thoughts to guide you in the process:

1. Am I seeking a one-time profit, or do I want to generate income?

A.) Fix and Flip:

The activity commonly known as “house flipping” has become increasingly popular over the past few years, with some reality television shows undoubtedly contributing to the popularity. If you do choose to buy and flip a home, doing it in the shortest period of time should produce the maximum one-time profit. However, like many financial matters, pulling that off may be easier said than done. With many of the nation’s more affordable fix and flip properties already largely picked over, and in a market generally featuring rising real estate prices, getting into a fix and flip today generally requires a much more significant capital expenditure (the cost of acquiring the property and repairs) than just a few years ago. Of course, the activity still has the potential to return a nice profit.

B.) Long-Term Ownership:

“Buy and Hold” real estate investing has been around longer than house flipping, partly because it historically has been attractive to major investors who are trying to provide a steady cash flow. Think of what you get as rent as your return on the investment you made when you bought the property. When considering a buy and hold real estate investment, focus immediately on the ongoing monthly costs of the mortgage, taxes, utilities, HOA fees, and maintenance. This total monthly outlay must be less than the amount for which the property can be rented, or your contemplated project is a non-starter.

2. What is the demand for renters in the area?

If you want to invest in buy and hold property, the first step is to assess the demand for renters in the area. Even if you find a great deal on an investment property, it won’t matter unless you can find someone to live there! Look at other rentals in the area and whether they are being filled. As a general rule, an area with a high percentage of condominiums, townhomes, and apartments has a high rental demand.

3. What is the local market like?

Even if home values are increasing nationally, they may not be increasing equally in your local market. In some areas of the U.S., home values have actually declined recently. It’s best to discuss the market with a knowledgeable real estate professional and to do your research. Also, focus on the local property taxes. For a buy and hold investor, property taxes are an important fixed cost that frequently is the determining factor on whether a profit can be realized on a particular property.

4. Should I manage the property or hire a property management company?

The answer to this question depends on how much time you have and whether it’s financially advisable to hire someone to manage the property for you. Do you want to deal with finding and keeping tenants? Are you able to do maintenance and repairs on the property when needed? Are you close enough in proximity to the property to manage it? Are you physically capable, and have the desire, to do these things? If not, property management companies generally charge 7 to 10% of the monthly rent, and sometimes the first month’s rent. If you can make a reasonable profit using a property management company, it probably is advisable to do so, as you will avoid the hassle that comes with finding and managing tenants.

5. Am I familiar with the laws and regulations of investing?

Always consult an attorney when deciding to invest in real estate. It’s essential that you have a proper knowledge of the laws and regulations, and follow them accordingly before becoming an investor, and then making a commitment to rent your property.

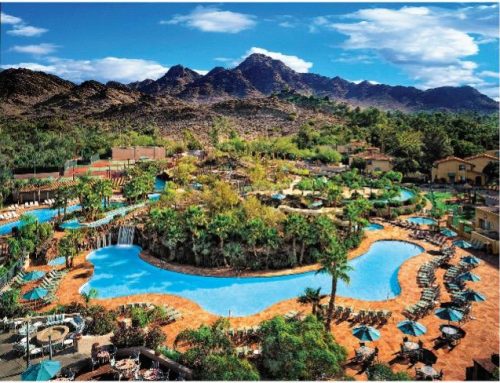

Brian Doherty, JD, LLM, ABR, PPS, is an Associate Broker with the office of RE/MAX Fine Properties in Scottsdale. He specializes in the purchase and sale of Arizona’s finest luxury homes, with particular emphasis on the communities of Scottsdale, Carefree, Cave Creek, and Paradise Valley. In addition to a legal background, he has earned specialized real estate designations as an Accredited Buyer’s Representative (ABR) and a Professional Property Stager (PPS). He has more than 25 years of experience with Arizona residential real estate.