By Lynn Janson, Realtor

In early January, the Bureau of Labor Statistics (BLS) released their most recent jobs report. The BLS report showed that Americans lost 140,000 jobs in December. That is a frightening number of lost jobs and will dramatically impact those households. As frightening and devastating as that number is, we need to give it some context.

Greg Ip, Chief Economics Commentator at the Wall Street Journal (WSJ), explains: “The economy is probably not slipping back into recession. The drop was induced by new restrictions on activity as the pandemic raged out of control. Leisure and hospitality, which includes restaurants, hotels, and amusement parks, tumbled 498,000.”

In the same report, Michael Pearce, Senior U.S. Economist of Capital Economics, agreed. “The 140,000 drop in non-farm payrolls was entirely due to a massive plunge in leisure and hospitality employment, as bars and restaurants across the country have been forced to close in response to the surge in coronavirus infections. With employment in most other sectors rising strongly, the economy appears to be carrying more momentum into 2021 than we had thought.”

As we continue to distribute the COVID-19 vaccine throughout the nation, and the pandemic gets under control, the vast majority of those jobs will eventually come back.

Additional comments from experts, also reported by the WSJ:

Nick Bunker, Head of Research in North America for Indeed: “These numbers are distressing, but they are reflective of the time when coronavirus vaccines were not rolled out and federal fiscal policy was still deadlocked. Hopefully, the recent legislation can help build a bridge to a time when vaccines are fully rolled out and the labor market can sustainably heal.”

Michael Feroli, Chief U.S. Economist, for JPMorgan Chase: “The good news in today’s report is that outside the hopefully temporary hit to the food service industry, the rest of the labor market appears to be holding in despite the latest public health challenges.”

What impact will this job market have on real estate in 2021?

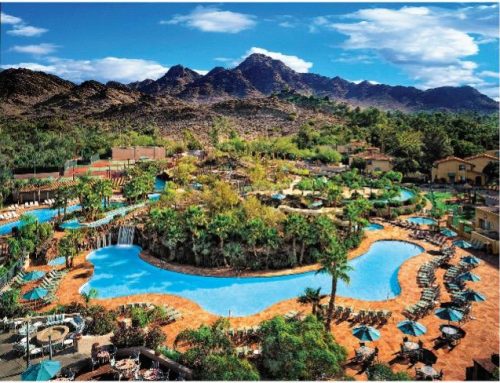

We may start seeing foreclosures and short sales again. If it will be like the Great Recession is doubtful. If we do start seeing foreclosures and short sales, Arizona may not experience it. Arizona is one of the places people from states like California, Illinois, and others, are moving to in droves.

Rick Sharga, Executive Vice President at RealtyTrac, doesn’t believe that a rise in foreclosures and short sales will be the case: “There are reasons to be cautiously optimistic despite massive unemployment levels and uncertainty about government policies under the new administration. But while anything is possible, it’s highly unlikely that we’ll see another foreclosure tsunami or housing market crash.”

Regardless of the prognosis for our economy, for the households impacted by job loss, the crisis is very real. However, things should vastly improve by mid-year with expectations that the jobs market will also progress significantly.

Lynn Janson is a Realtor with LIV AZ Realty. She can be reached at [email protected] or 602-300-0797.